Investments

We understand that trying to time the market or invest in the hot stock of the day can be very tempting, but a diversified investment strategy is a better more stable way to help you reach your goals in the long-term

Add your custom HTML here

Our ApproachBeyond the Efficient Frontier

Investments and markets fluctuate over time, as professionals, we help you make informed financial decisions with a full complement of resources. Our process gives you a framework to collaboratively make decisions and monitor those decisions over time. Each step involves interaction between our team, you and outside professionals if needed. Specifically, you can count on us to work closely with you in the following manner:

STAGE 1: Understand

We use a variety of tools to understand your personal goals, current financial situation, investment experience and risk tolerance. We make you fully aware of our capabilities and provide educational support to assist you in understanding the scope of services we offer to help you meet your objectives.

STAGE 2: Design

We analyze the information you share and designs solutions to help reach your objectives. We present you with our recommendations. We answer your questions so you can consider alternatives and then we outline the steps we need to implement your plan.

STAGE 3: Implement

We execute your custom strategy using the tools available to us. With specific account types, investment products and optional services, we complete the paperwork necessary in a coordinated approach.

STAGE 4: Manage

We continually monitor and report the progress of our recommendations through periodic reviews so that you can be involved in the process.

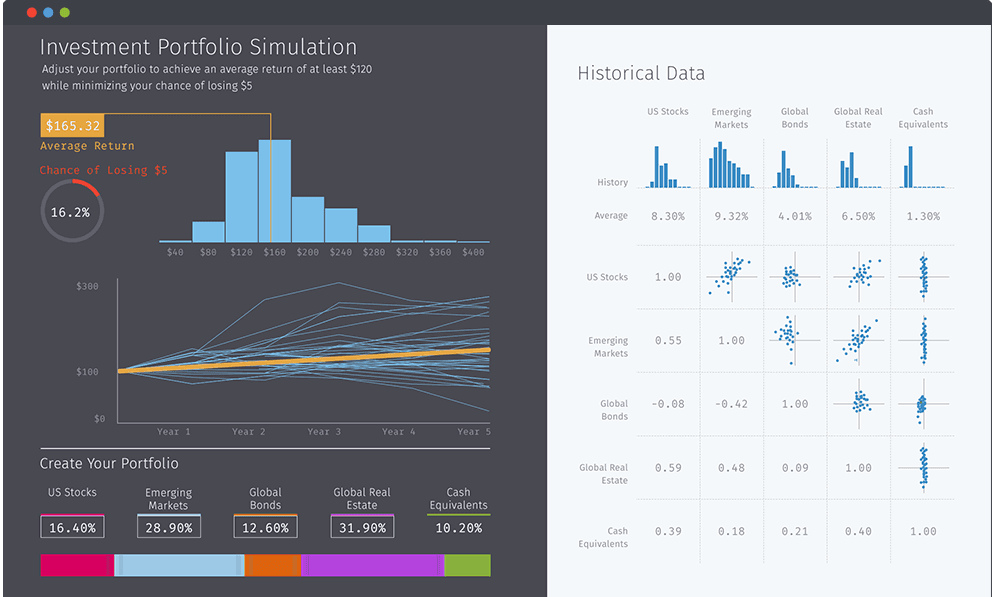

Custom Portfolio Design

When you become a client, we will ask a few questions to determine your preferences as an investor and build your portfolio with different asset classes. Your portfolio will be designed to maximize after-tax, real investment returns while providing a personalized approach for your individual investor preferences.

You will also have the chance to trade on your own behalf.

Why Risk Matters

The graphs below illustrate the level of growth you would need to break even after a loss.

11.11%

10% Loss

17.65% Gain

15% Loss

33.33% Gain

25% Loss

100% Gain

50% Loss